Currently, cases regarding phishing and online fraud are on the rise, which poses a threat to Malaysians. Many had fallen victim to these schemes and had thousands, even millions stolen from their savings. Some were able to pinpoint how they were hacked, but some had no idea what caused them to lose thousands within minutes.

Around RM14,000 stolen from savings account

Facebook user, Mia Jia Xin has just become a victim of an online scam when she lost RM14,000 to an unknown account. The money transfer was carried out in two different transactions, and it was completed in just 1 minute. Jia Xin was shocked when she received the SMS notifying her of these transactions carried out without her consent.

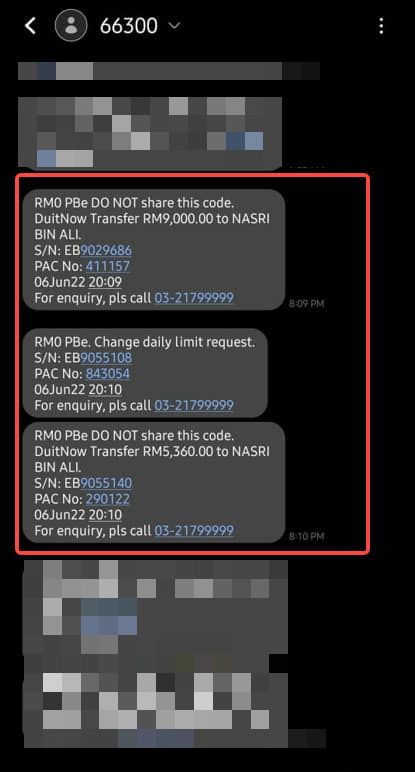

She posted a screenshot of the SMSes, which shows how her money was transferred to an unknown account owned by one ‘Nasri Bin All’. The first transaction consisted of RM9,000 being sent via DuitNow, and the second one remitted RM 5,360. The TAC codes were also visible, indicating that transfers were being made from her account.

The screenshot proved how the hacker was able to change the money limit without the account owner providing any TACs to them. In which case, the hacker was capable of wiring any amount of money out of any account they wanted.

Jia Xin also said that she even doubted that the hackers required TACs for the job, as she has heard of victims reporting similar cases without receiving any TACs.

Slow responses from the victim’s bank

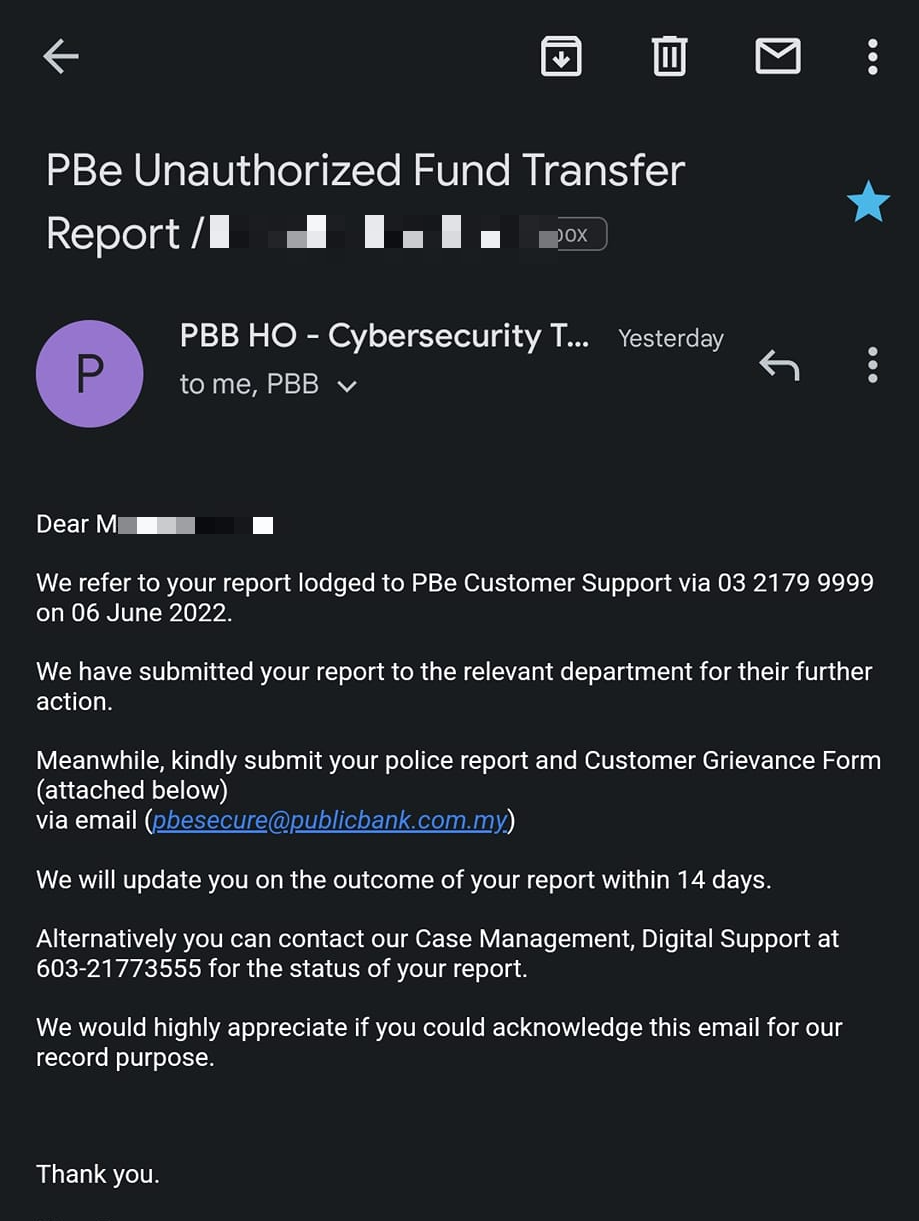

After she saw the SMSes, Jia Xin immediately called her bank, Public Bank, to report the unapproved transactions. However, the customer line was busy, and with each second passing, she was adamant that the hackers were already transferring the money to another account to make it harder to trace.

Moreover, her disappointment rose when the case manager told her that there was no guarantee that she would recover the money, although she immediately reported the suspicious activity to the bank.

“From my understanding, Public Bank is telling me to take my own risk when it comes to saving with them,” Jia Xin said.

After waiting for 6 days, she told Wau Post that she tried calling the bank security support number provided in the email from Public Bank, but to no avail.

“I have no choice but to call the PBE general line, asking them to help me send an escalation email to arrange a callback from the respective team. Until now, there was still no update yet,” she added.

Jia Xin confirmed that she did not click on any phishing links, or installed any APK files/ software from suspicious websites. Before the hacking occurred, she was just using the PBE Online Banking app to pay her credit card instalments.

In her post, she shared her disappointment when she was told that the investigation would take 2 weeks and that there was no assurance that she would get her money back.

“It seems like there’s nothing I can do besides just waiting in this helpless situation.”

Given her experience, she hopes that other users would be more wary of other scam operations such as those that operate via calls, or require the use of Android Package Kits (APKs), so that they would be able to avoid ending up similar situations.

Tap here to give us a ‘Like’ on Facebook and stay up-to-date on the latest news!