Every year come March, we Malaysians are reminded that there are simply no things more certain in life than paying off your taxes. And with income tax season dawning upon us again, many of us are now no doubt in the midst of figuring out what number of purchases we have made from the past year would be eligible for a tax relief claims in our BE forms for Assessment Year 2021.

But first, do you have your own tax number from LHDN?

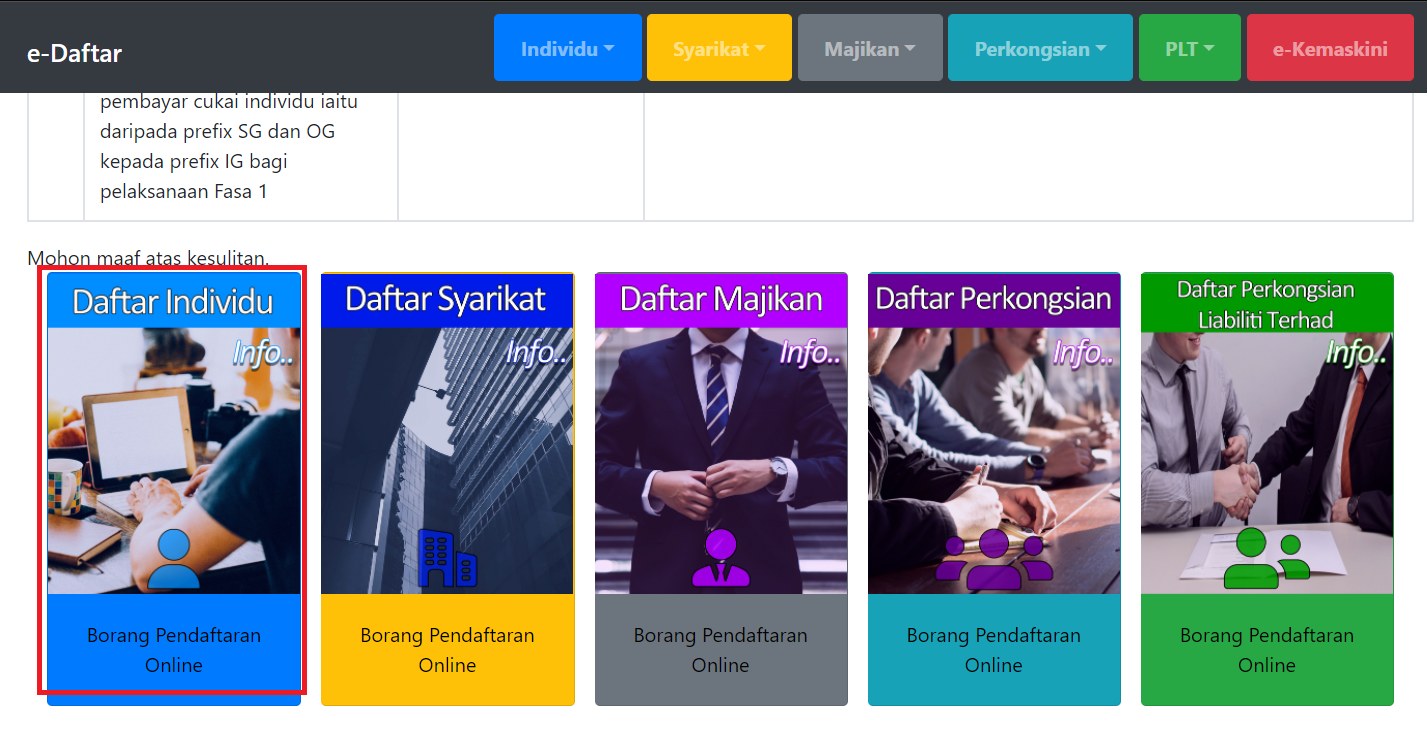

For first-time taxpayers, you must first register yourself as a taxpayer with the Inland Revenue Board (LHDN) and obtain your very own unique tax number before doing anything else. In order to do so, head to the Inland Revenue Board’s (LHDN) eDaftar website by clicking on this link here. Upon arriving on the page, scroll down until you see ‘Borang Pendaftaran Online‘ and click on it.

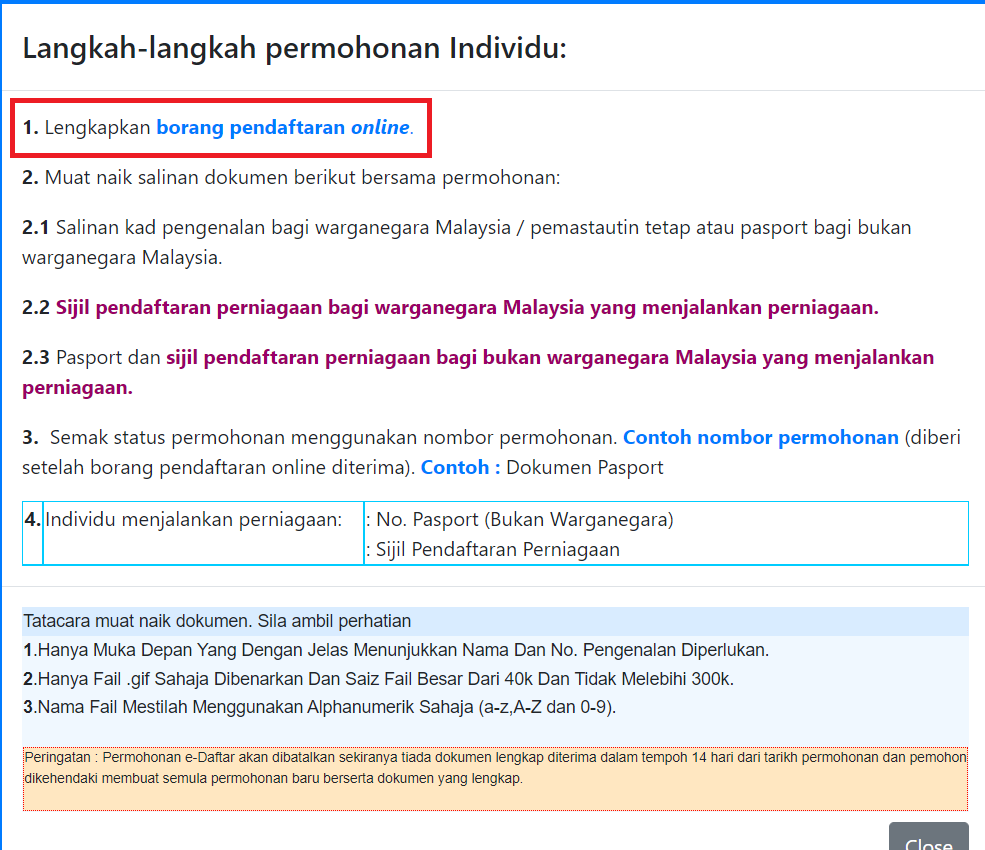

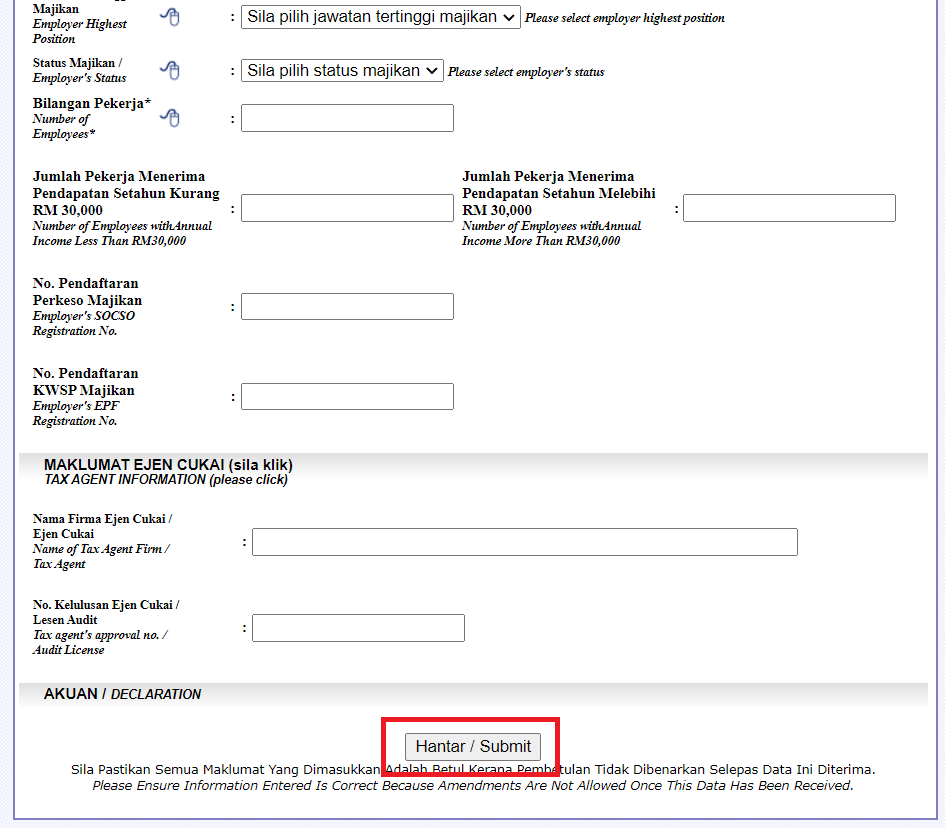

This will then lead you to a form, which you will have to fill out with all the necessary information. Be sure that the information you have declared is accurate, as it will determine which LHDN branch your tax file will be associated with. You can of course register to be a taxpayer through LHDN’s physical offices, but the public have been encouraged to turn to using the online option due to the rising number of COVID cases in the country.

Naturally, if you are completing the form online you will also need to provide a digital copy of your IC for verification purposes. This is in addition to information about your employers, so you may need to contact your HR representative for a little help here.

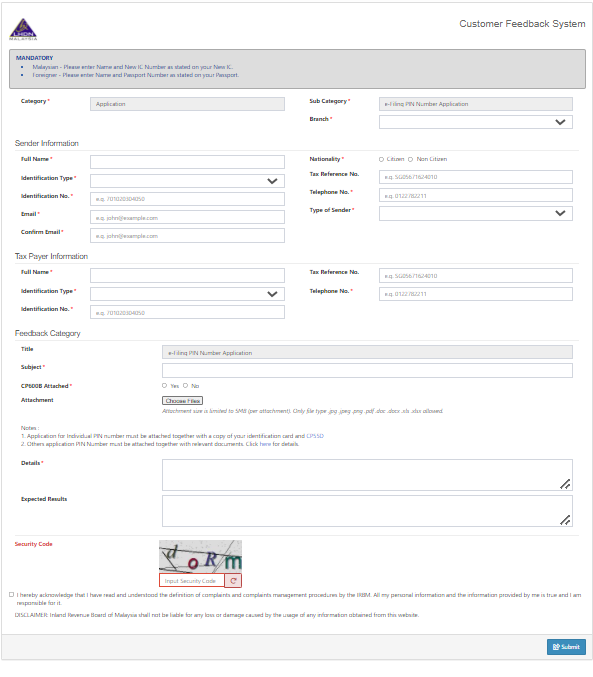

Once you have completed your form, be sure to check it over again and be sure that all your supporting documents are enclosed before submitting. However, if you did leave out any supporting paperwork, fret not. You can send them in later via the LHDN Customer Feedback site within 14 days of your e-Dafter submission.

You will then need to wait up to three working days before you’ll receive an email containing your tax file number. You may also check back on the e-Dafter website or give LHDN offices a call to check on your status.

Time to register for ezHasil

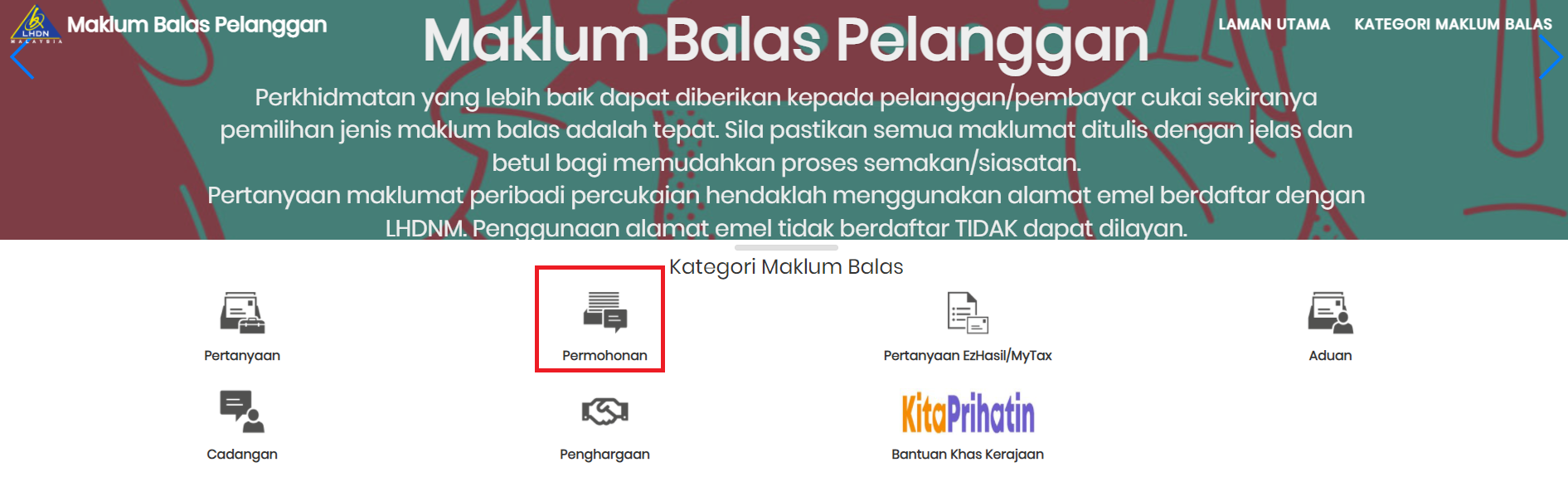

Once you have your tax file number, it’s time to register for your ezHasil account, where you can do your e-Filing. In order to do so, you will require your first-time PIN from LHDN, which can be obtained either from its physical offices or online from the LHDN Customer Feedback website here.

If you choose to do it online, follow these steps:

1. Select ‘Application’

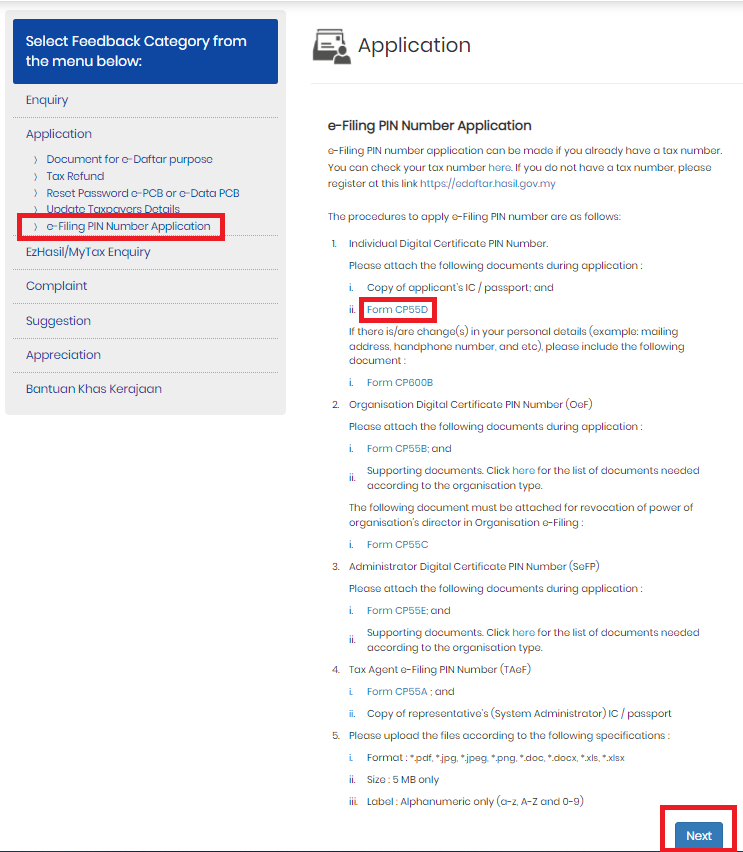

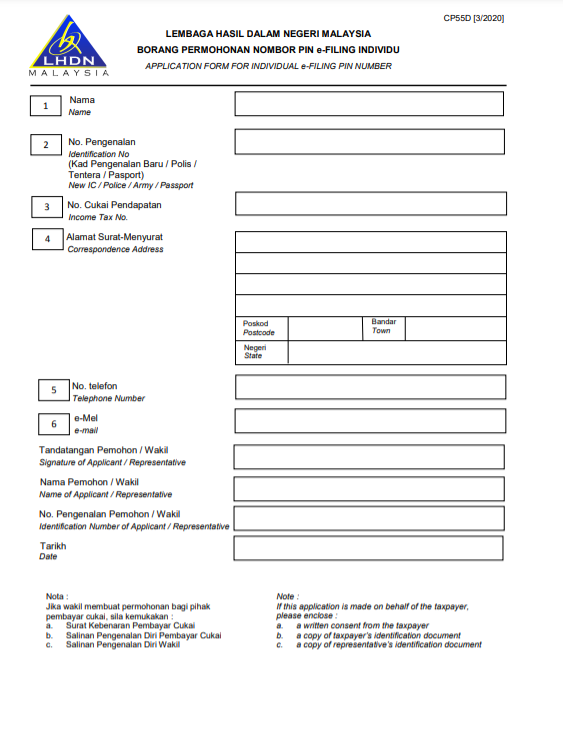

2. Click on ‘e-Filing PIN Number Application’, then click on ‘Form CP55D’ and fill it out

3. Hit ‘Next’ and fill in the required fields and include all the supporting documents requested (Form CP55D and a digital copy of your IC)

5. Hit ‘submit’, and your PIN will be sent to you within 7 working days.

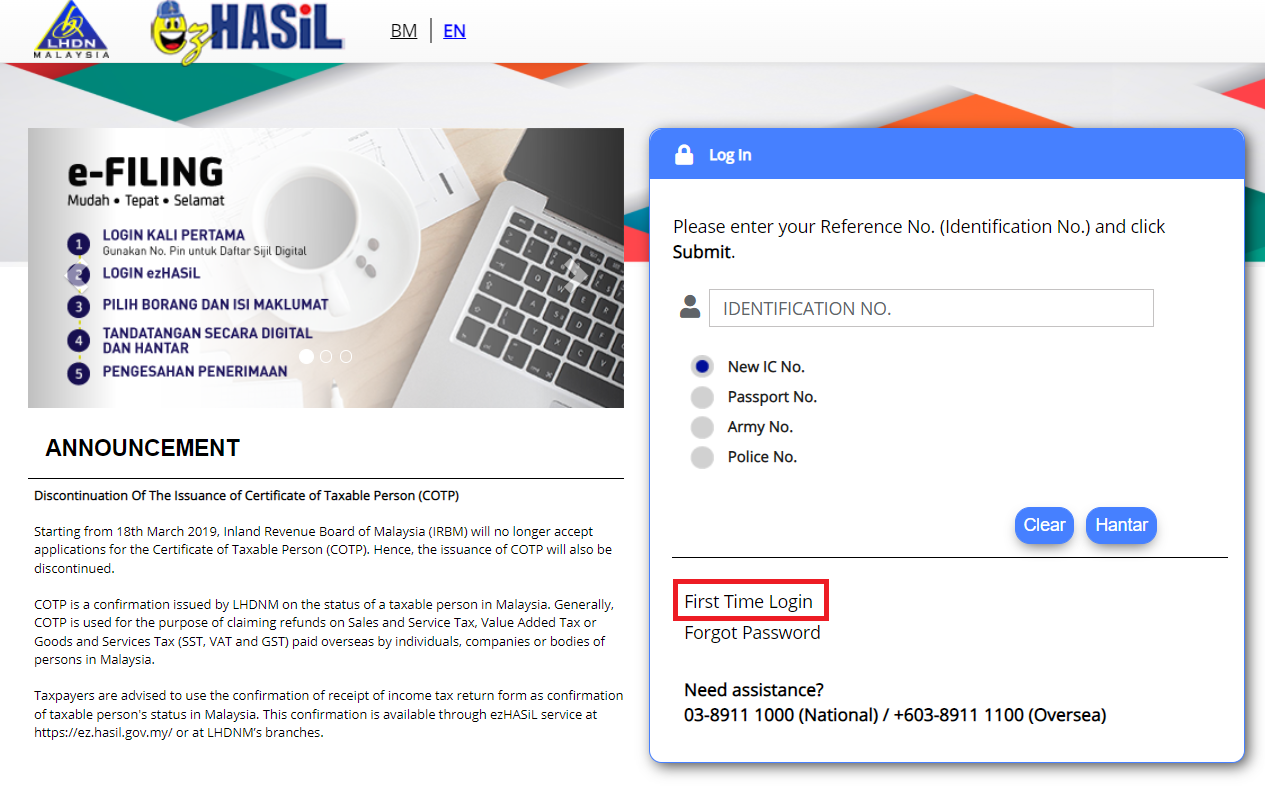

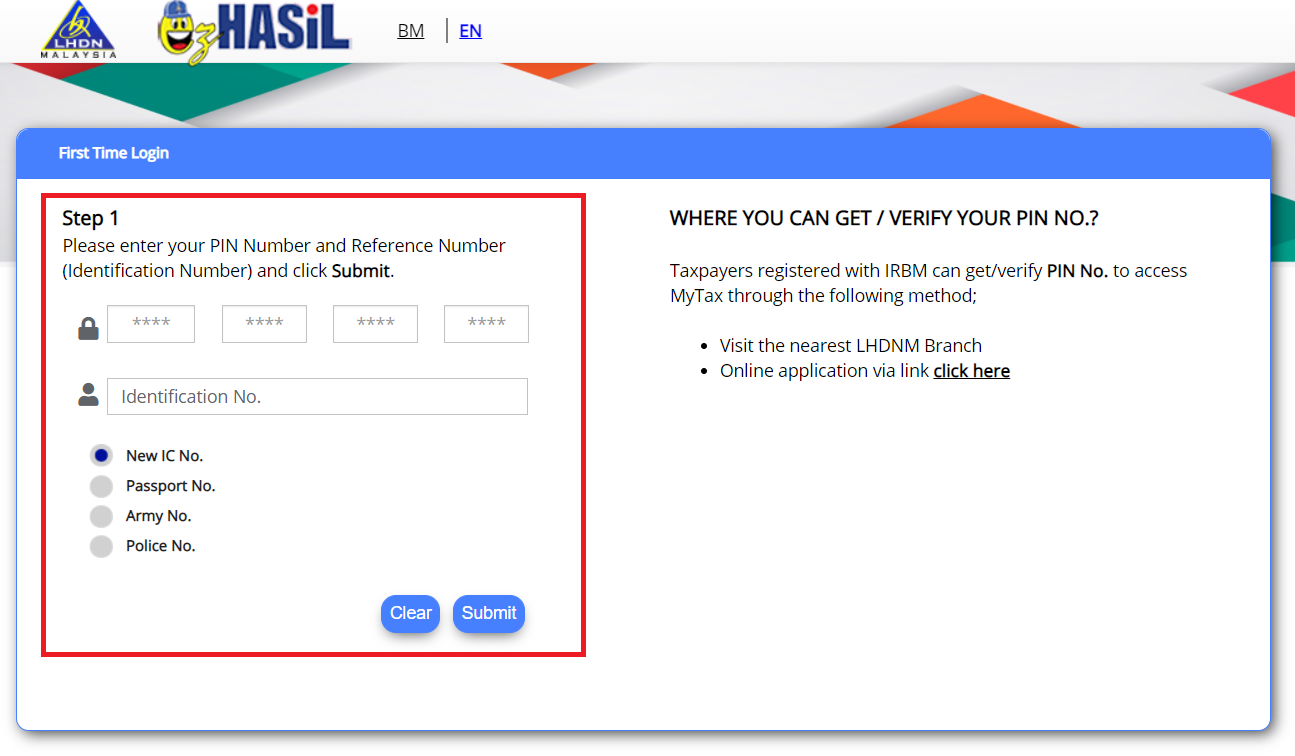

Once you have obtained your PIN, head to ezHasil by clicking here and selecting ‘First Time Login’. Enter your PIN in the text box as indicated, along with your chosen form of identification. You will then be directed to a form, which you must fill out. Be sure that your tax file number is correct before submitting!

You will also be requested to provide a password. The next time you log into your ezHasil account, you will only need to use this password and not the PIN. When you’re all done, submit the form and head back to the homepage. This time, log in with your IC number and select ‘Hantar’, which will direct you to a screen to input your password. You may also be prompted to set up your security phrase at this point, which you should do to prevent unauthorised access.

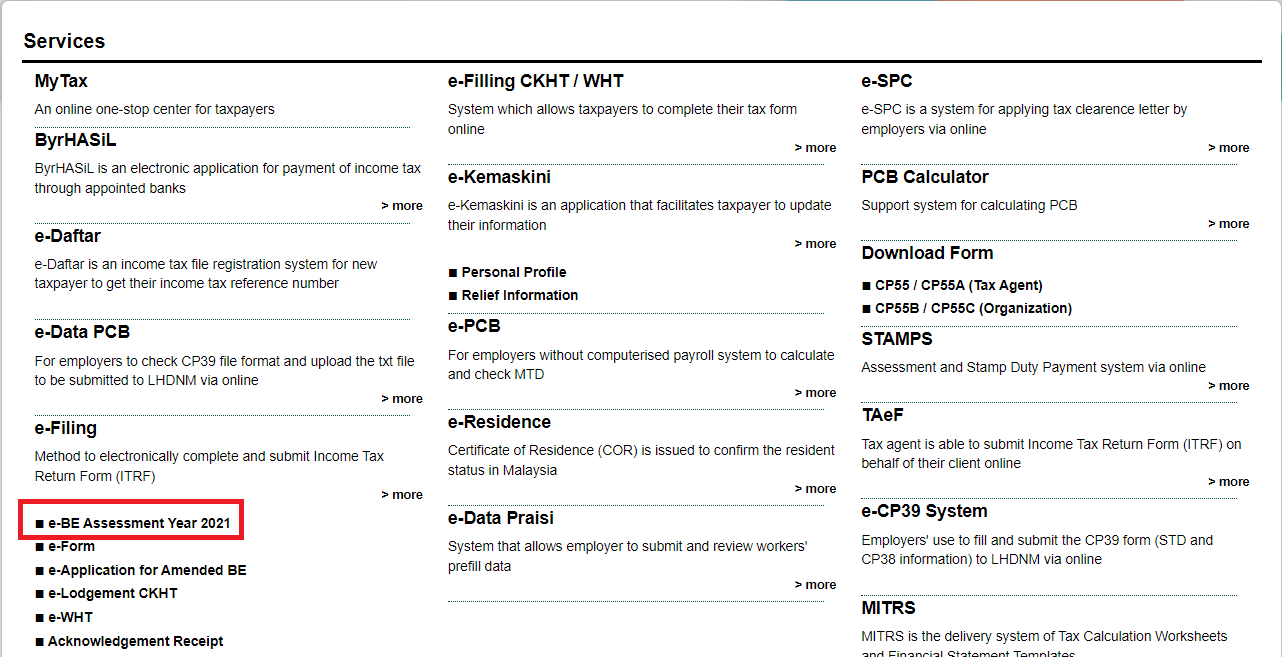

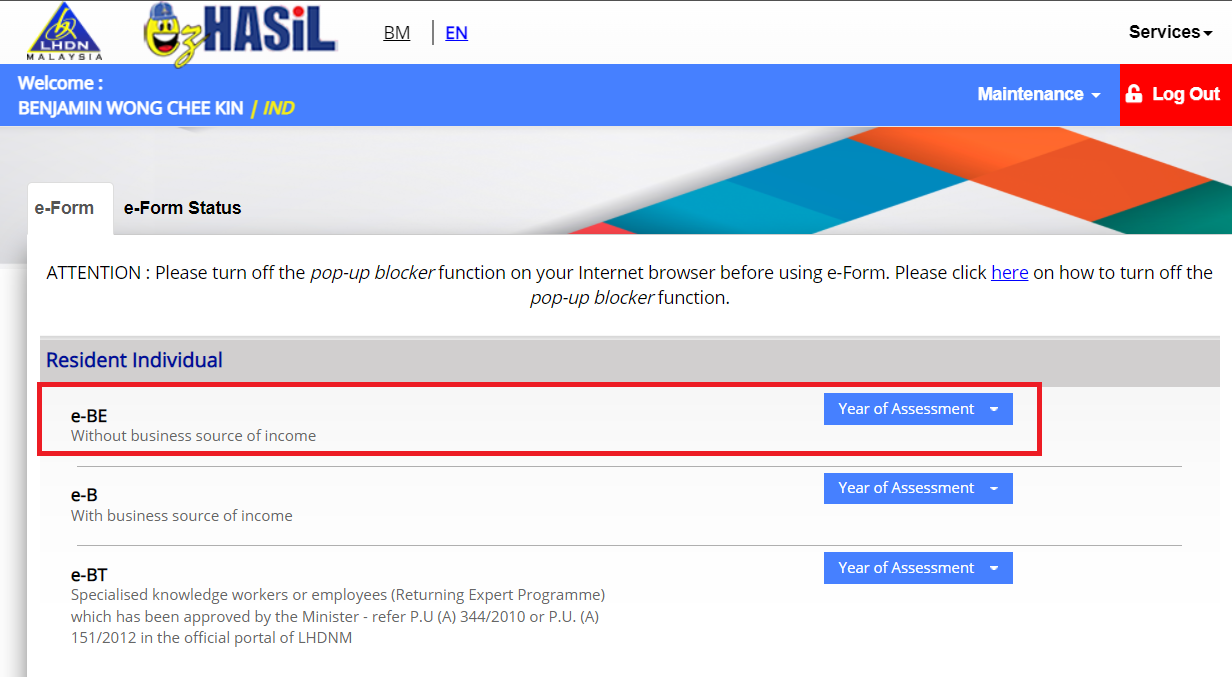

Once you’re all done, pop into your ezHasil dashboard, select e-Filing, then e-BE for YA 2021.

Tax relief for YA 2021

Now, let’s take a look at what you can deduct from your tax filing this year. But keep in mind, in order to be eligible for these claims, you need to provide proof of payment in the form of receipts!

Individual

- RM9,000 – Individual and dependent relatives

- RM8,000 – From medical treatments with a medical condition certified by a medical practitioner, special needs or care expenses for parents

- RM4,000 – For those with a spouse that do not have their own source of income or do not have any source of taxable income, or for men making alimony payments

Lifestyle

- RM2,500 – Lifestyle expenses for own self or for own child.

1. Any purchase of reading materials.

2. Any purchase of personal computers, smartphones, or tablet devices for personal use.

3. Any purchase of sports equipment.

4. Any payment for Internet subscriptions under your own name. - RM2,500 – Additional relief for tech purchases

1. Any additional purchases of personal computers, smartphones, or tablet devices for own self/child/spouse

2. Must be for personal use only. - RM500 – Additional relief for sports purchases

1. Any purchase of sporting goods.

2. Any payment that goes towards the rental or admission fees to any sporting facilities in Malaysia.

3. Any payment that goes towards the registration of any licensed sports competition. - RM1,000 – Relief for domestic travel

1. Any payment that goes towards the purchasing of travel accommodations registered with MOTAC.

2. Any payment that goes towards the admission fees of a local tourist attraction.

3. Expenses must have been made between 1st March 2020 to 31st December 2021.

Education & Medical

- RM7,000 – Education expenses for own self

1. Any masters or doctorate course

2. Selected non-masters or doctorate courses

3. Upskilling courses or self-enhancement classes offered by a recognised institution (RM1,000 max) - RM8,000 – Medical expenses

1. Medical expenses incurred from serious diseases for self/spouse/child

2. Medical expenses incurred from fertility treatments for self/spouse

3. Vaccination expenses incurred for self/spouse/child (max RM1,000)

4. Complete medical check-ups for self/spouse/child

5. COVID-19 tests, inclusive of home-test RTK Antigen kits as well as lab RT-PCR tests for self/spouse/child

For parents

- RM8,000 – For any child who is unmarried, aged 18 and older, and who is currently receiving tertiary education whether it be diploma, degree, or higher levels.

- RM8,000 – For SSPN net deposits

- RM3,000 – Childcare expenses

1. For children aged 6 and below.

2. Expense must be made through a registered childcare centre or kindergarten. - RM2,000 – For any child aged 18 and above who is currently a full-time student (A-levels, matriculation, foundation/preparatory courses)

- RM2,000 – Any child below 18 years of age.

- RM1,000 – For any breastfeeding equipment.

For investment/insurance

- RM7,000 – For expenses incurred in the purchasing of life insurance & EPF

1. Public servants who are eligible to receive pensions with life insurance premiums.

2. Private sector employees who have life insurance premiums )max RM3,000 claim), or are contributing to EPF/any approved scheme (max RM4,000 claim) - RM3,000 – Deferred annuity and private retirement schemes

- RM3,000 – Education and medical insurances

- RM350 – SOCSO

For disabled individuals

- RM6,000 – For any disabled individual

- RM6,000 – For expenses incurred purchasing basic support equipment that goes to the care of a disabled individual, whether it be own self/spouse/child/parent

- RM6,000 – For the expenses incurred from taking care of a disabled child. Parents may receive an additional exemption of RM8,000 for disabeled children aged 18 and older who are not married, and are currently pursuing tertiary education.

- RM5,000 – For the expenses incurred in caring for a disabled spouse.

For more news like this, follow us on Facebook by tapping here!