Online shopping is a multi-billion dollar industry that is set to continue growing, as consumer trends begin gradually shifting away from brick-and-mortar retail outlets. And that comes as no surprise in the wake of the COVID-19 pandemic pushing companies to digitise many of their operations, in addition to the obvious benefits that a virtual environment can provide to shoppers, such as in terms of choice and more competitive prices.

With that being said however, your online shopping habit could potentially wind up becoming a little more expensive in the future as a new 10% Low-Value Goods tax has just been passed by the Dewan Rakyat yesterday (August 4th 2022).

10% Low-Value Goods tax has been passed by Dewan Rakyat

According to the New Straits Times, the Sales Tax (Amendment) Bill 2022 was green-lit with a majority voice note, which will now be included as a new provision to the Sales Tax Act 2018 regarding taxation on low-value goods sold online and imported into the country.

The bill was tabled for its second and third reading by Deputy Finance Minister I Datuk Mohd Shahar Abdullah, who said that the expansion on sales tax is expected to help provide a more level playing field to both local and foreign online sellers alike while preventing individuals from exploiting a lack of sales tax for imported low-value items.

This is to create a level playing field between local and international online sellers

The bill also forms part of the government’s revenue sustainability initiative which was introduced during Budget 2022, according to The Edge Markets.

“Based on the bill, the definition of sellers will now include people selling low-value goods or operating a marketplace online regardless of nationality or geographic location,”

“The proposal to expand the scope is not a step backwards and Malaysia is not the only one that will or has implemented it. At the global level, countries such as Australia, New Zealand, the UK and Norway, have already imposed either goods and services tax (GST) or value added tax (VAT) on low-value goods.

“Singapore has also implemented the same thing from Jan 1, 2023 whereby goods worth S$400 (and below) are subject to GST at a rate of 7%,” he told members of the Dewan Rakyat.

As of present, imported goods with a retail value of under RM500 are not subject to any forms of tax upon arriving in Malaysia from abroad. This is in contrast against domestically produced goods sold by local vendors, which are subjected to sales tax of between 5% to 10%.

This new Low-Value Goods tax is expected to bring in an additional RM200 million in tax revenue per annum, and is targeted for implementation on January 1st, 2023. A flat rate of 10% is expected to apply on imported goods bought online with a retail value of less than RM500.

Tap here to give us a ‘Like’ on Facebook and stay up-to-date on the latest news!

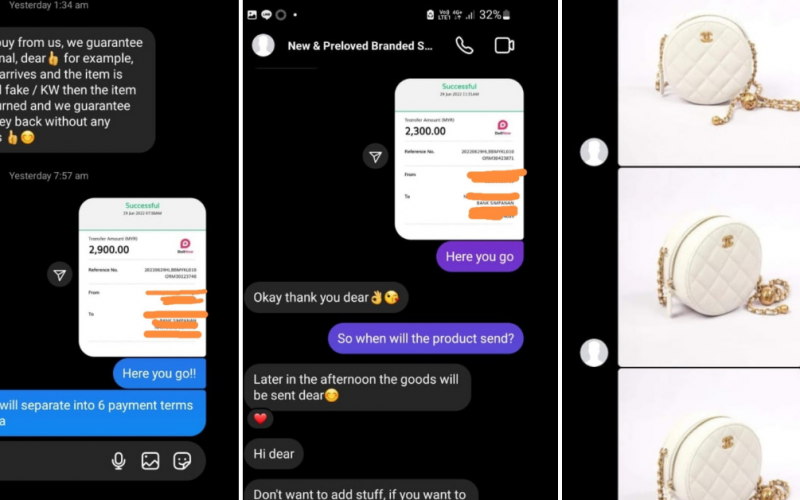

Also read: M’sian woman gets scammed out of RM5,200 after trying to buy Chanel bag from online seller