At this point, we are all no doubt familiar with the many precautionary warnings, reminding us to constantly stay alert and be wary of our surroundings, so that we do not fall victims to scammers. Unfortunately, as they grow increasingly more complex and sophisticated in nature, those who are less tech-savvy or aware may find themselves being duped out of their hard-earned money without even realising that it has happened until it’s too late.

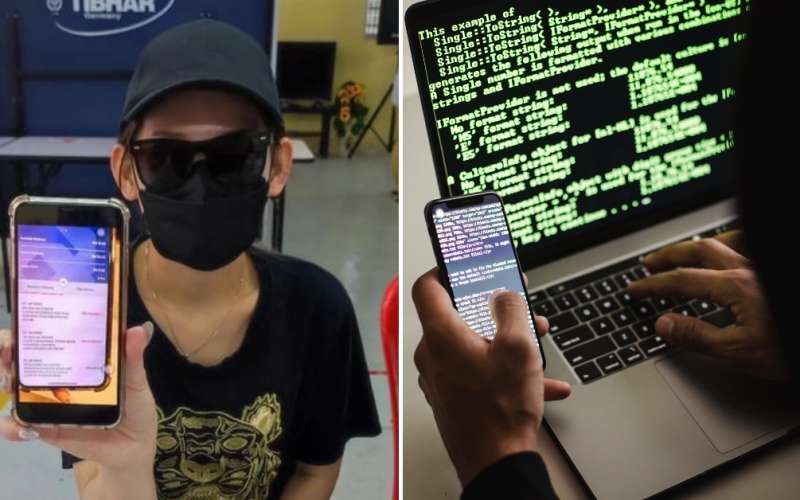

And this is exactly the case with a Malaysian single-mother who recently lost a large portion of her life savings by just answering a random phone call. As reported by local paper Sin Chew Daily, the victim has been identified as a 32-year-old woman who went by the surname Wong.

Single-mother who works as a freelance manicurist receives call from unknown number

During a press conference held by Head of DAP Women in Pandan, Alice Tan, Ms Wong claims that she had received an annonymous call via the popular messaging platform Telegram while having a dinner with a friend in Klang at around 7.00pm on July 2nd 2022. Working as a freelance manicurist, Ms Wong would publish her contact details across social media to promote her business and would often receive calls and messages from unknown numbers who were usually potential clients.

Thinking that it was a prospective customer, she answered the call and a person on the other end of the line inquired about her services in Mandarin. Speaking for over ten minutes, the individual asked for detailed information about her business, such as her location. However after they hung up, she realised that the individual did not ask her for an appointment.

Checked her account after the call and discovered her money missing

Puzzled, Ms Wong decided to call back. only to realise that her number has been blocked by the caller. But what left her truly shocked was when she checked her bank details, she found that RM66,996 had been transferred out of her savings account!

“During this period, the victim did not receive any SMS for Transfer Authentication Codes (TAC).” Tan explained.

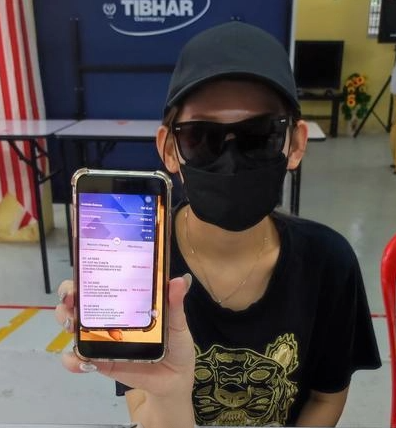

Bank transfer records indicated that the substantial amount was wired through six different online transactions occurring between 7.09pm and 7.22pm. Of the six transactions, two were carried out using FPX transfer.

The victim proceeded to contact her bank, which confirmed that the transactions had indeed been made from her account. She subsequently lodged a police report over the matter.

“Investigations carried out by the bank indicated that 6 transactions had indeed been made from her account, and had been carried out under normal procedures.

TAC codes were sent to the victim’s mobile phone during each transaction, and no abnormalities were present. As such, the bank was not at fault and the victim isn’t liable to any compensation.”

Transactions were made to multiple parties

The two transactions that were carried out using FPX were to bank accounts owned by private companies. While one company expressed shock at the allegations upon being contacted and promised an investigation, authorities were not able to reach the other. The remaining transactions were made out to a bank account owned by a Malay individual, however police notes that it could have been a dormant account owned by an unknowing party.

When asked about why the victim did not receive any TAC codes in her mobile phone, her bank claims that they have received numerous similar complaints from customers and suspected that her phone may have been hacked, leading to the TAC codes to be intercepted.

Wong, who is the mother of two-children, said that it took her almost half a year to accrue the amount that was stolen from her, and said that she has never encountered any scams previously, nor downloaded any suspicious apps or made any questionable investments.

Tap here to give us a ‘Like’ on Facebook and stay up-to-date on the latest news!

Also read: M’sian loses a whopping RM28,500 from her account after being duped by online travel agency scam